Pharmacy Benefits: What You Really Get from Your Prescription Coverage

When you hear pharmacy benefits, the set of rules and coverage options your health plan provides for prescription drugs. Also known as drug benefits, it’s not just about whether your medicine is covered—it’s about how much you pay, how often you can refill, and why your doctor might need to jump through hoops to get you the right pill. Most people think pharmacy benefits are simple: if your drug is on the list, you’re good. But the truth? It’s a maze of tiers, prior authorizations, step therapy, and hidden costs that can make even basic meds feel like a luxury.

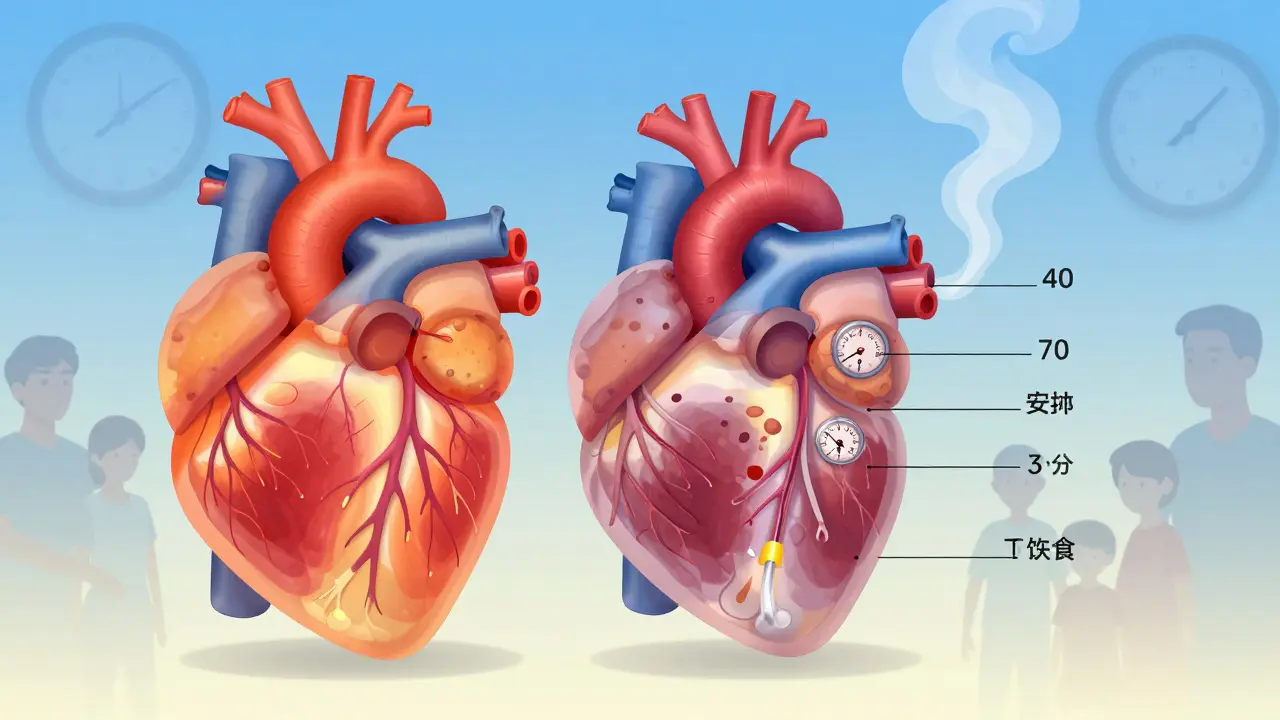

Behind every pharmacy benefit is a formulary, a list of drugs your insurance plan agrees to cover, often grouped by cost tiers. Also known as drug list, it’s not set in stone—plans update them yearly, and some drugs get bumped down to higher tiers or removed entirely. That’s why you might pay $5 for a generic one month and $75 the next. And while generic drugs, chemically identical versions of brand-name medications that cost far less. Also known as off-patent drugs, are supposed to save you money, not all plans treat them equally. Some require you to try two or three generics before approving the brand, even if the first one didn’t work for you. This is where prescription coverage, the extent to which your insurance pays for medications, including co-pays, deductibles, and out-of-pocket limits. Also known as drug insurance, gets tricky. You might have great coverage on heart meds but zero coverage on hair loss treatments or supplements like Baikal Skullcap—even if your doctor recommends them. And let’s not forget medication access, how easily you can actually get your prescribed drugs, influenced by pharmacy networks, shipping delays, and insurance restrictions. Also known as drug availability, because even if your plan covers a drug, the nearest pharmacy might be out of stock, or your insurer might refuse to pay unless you submit a 10-page form. That’s why posts here cover everything from switching back to brand-name meds safely to verifying your pharmacy’s details on the label. These aren’t just tips—they’re survival skills in a system designed to confuse you.

What you’ll find below isn’t theory. It’s real stories from people who’ve been stuck between insurance rules and their health needs. You’ll learn how the FDA tracks generic drug safety after approval, how to read your medication guide for overdose warnings, and why some drugs—like rivaroxaban for kids or azithromycin for ear infections—are prescribed off-label. You’ll see how age, breastfeeding, and even brain surgery can change what’s covered and what’s not. This collection is for anyone who’s ever been told, "It’s not covered," only to find out later it was never meant to be. Pharmacy benefits aren’t about health—they’re about economics. But you don’t have to accept that. Know your rights. Know your meds. And know how to fight for what you need.