Insurance Savings: How to Cut Drug Costs Without Sacrificing Care

When it comes to insurance savings, the money you keep from lower drug costs thanks to better coverage or smarter choices. Also known as prescription savings, it’s not just about having insurance—it’s about using it right. Millions of people pay more than they need to because they don’t know how to navigate their plan’s formulary, compare generic options, or spot hidden costs like tiered pricing or prior authorizations.

generic drugs, the same active ingredients as brand-name meds but often 80% cheaper. Also known as generic medications, they’re not second-rate—they’re legally required to work the same way. The FDA’s post-market surveillance, the system that tracks drug safety after approval. Also known as FDA Adverse Event Reporting System, ensures generics stay safe, even if they’re sold at a discount. That’s why switching from brand to generic isn’t a compromise—it’s a smart financial move, as long as you know how to do it safely, like in our guide on switching back from generic to brand.

But insurance savings don’t stop at generics. Your plan might cover certain drugs better than others. Some require you to try cheaper options first—this is called step therapy. Others have high copays for specialty meds, like those for cholesterol or diabetes. That’s where knowing your prescription costs, the actual price you pay after insurance kicks in. Also known as out-of-pocket drug expenses, helps you decide whether to pay upfront, use a mail-order pharmacy, or even buy online from verified sources, like how people safely buy cheap generic Crestor or azithromycin. You’re not alone if this feels confusing. Many patients don’t realize their pharmacy can call your insurer to check coverage before they fill the script. Or that some manufacturers offer coupons that stack with insurance. Or that switching to a different plan during open enrollment could save hundreds a year.

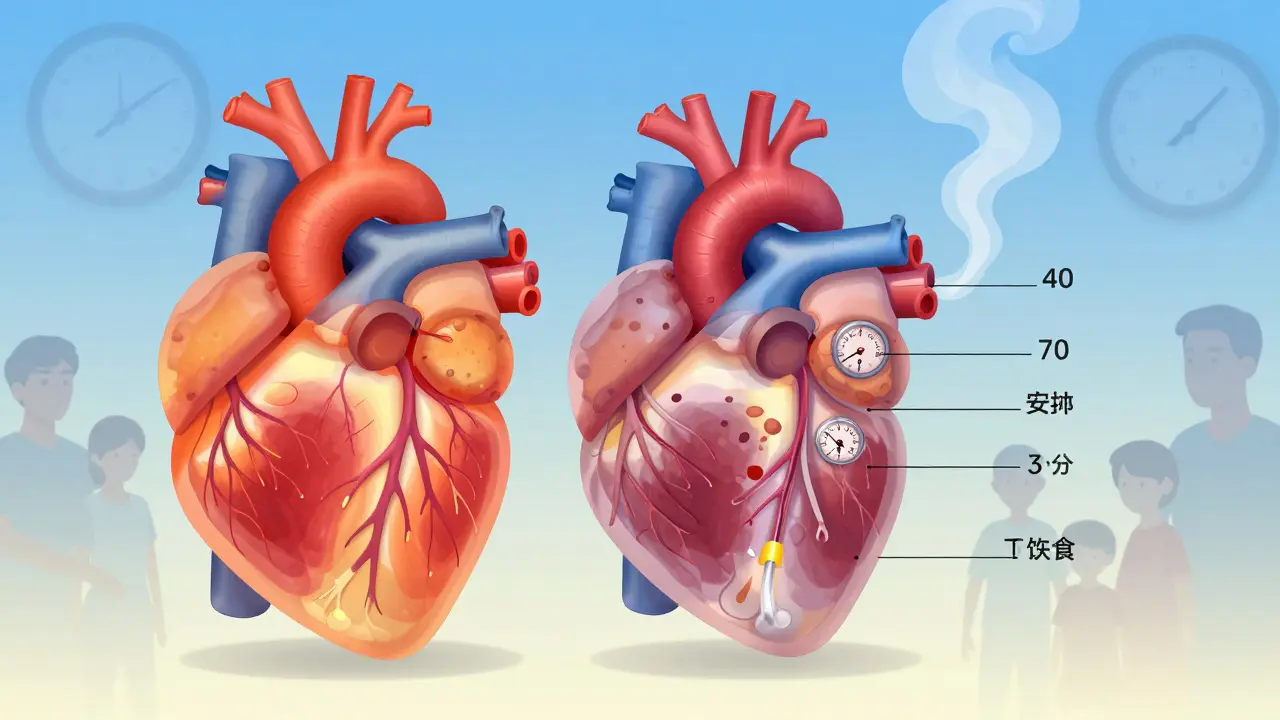

And it’s not just about the drug itself—it’s about how you use it. For example, if you’re on a long-term med like azathioprine for transplant rejection or donepezil for Alzheimer’s, small changes in timing or dosage can reduce side effects and avoid costly ER visits. Same with metformin or lisinopril. Managing your meds well means fewer complications, fewer doctor visits, and less strain on your insurance. That’s real insurance savings.

What you’ll find below isn’t a list of random articles. It’s a collection of real, practical guides written by people who’ve been there: patients who saved hundreds by switching to generics, caregivers who learned how to verify prescriptions to avoid dangerous errors, and folks who figured out how to buy safe meds online without getting scammed. Whether you’re struggling with high copays, confused about your formulary, or just tired of overpaying for pills, these posts give you the exact steps to take. No fluff. No theory. Just what works.