Let’s say you take a generic blood pressure pill every day. It costs $10 per prescription. You’ve paid $300 in copays this year just for that one med. You might think, ‘I’ve already paid $300 - shouldn’t that count toward my $2,000 deductible?’ The answer? It doesn’t. But here’s the twist: it does count toward your out-of-pocket maximum. And that’s the real safety net.

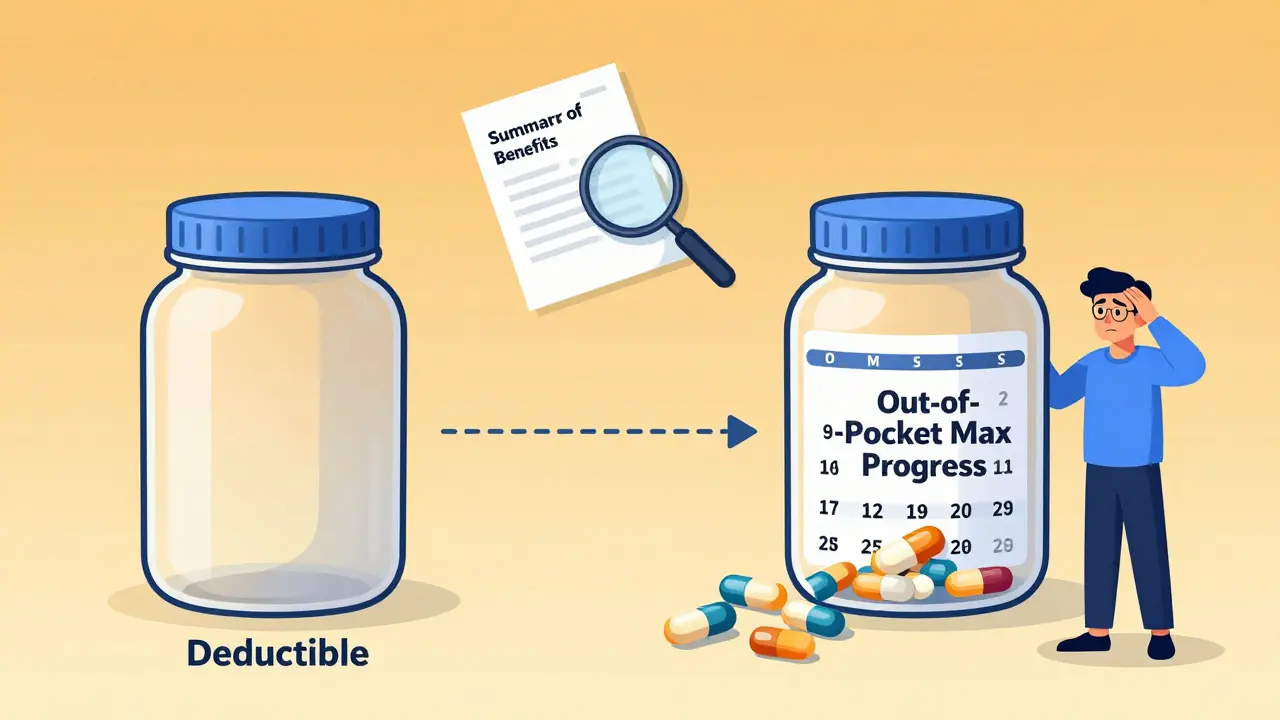

What’s the difference between a deductible and an out-of-pocket maximum?

Your deductible is the amount you pay before your insurance starts sharing the cost of most services. For example, if your deductible is $1,500, you pay 100% of covered medical bills - doctor visits, lab tests, hospital stays - until you’ve spent that $1,500. Then your insurance steps in with coinsurance.

Your out-of-pocket maximum is the most you’ll ever pay in a year for covered care. Once you hit that number - say, $8,500 - your insurance pays 100% of everything else for the rest of the year. This includes hospital bills, surgeries, and yes, even your daily prescriptions.

The key point? Generic copays don’t reduce your deductible. But they do chip away at your out-of-pocket maximum. That’s why someone paying $10 copays for 12 months ($120 total) might still have a $1,500 deductible left to meet - but they’re $120 closer to hitting their $8,500 cap.

Why does this confusion exist?

Before 2014, copays didn’t count toward anything. You paid them, and they vanished - no progress on your deductible, no progress on your out-of-pocket limit. That was brutal for people with chronic conditions. Insulin, asthma inhalers, blood thinners - all cost money, every month, with no end in sight.

The Affordable Care Act changed that. Starting in 2014, all new plans had to make sure every dollar you spent on in-network care - copays, coinsurance, deductibles - counted toward your out-of-pocket maximum. That was a huge win. But it didn’t change how deductibles work. Copays still don’t count toward them.

So now you’ve got a two-track system:

- Track 1: Deductible - Only counts money you pay directly for services before copays kick in (like a $200 MRI or a $500 ER visit).

- Track 2: Out-of-pocket maximum - Counts every copay, every coinsurance payment, every dollar toward your deductible.

This setup creates a hidden trap. People think, ‘I paid $2,000 in copays - I must be close to meeting my deductible.’ Nope. You’re close to hitting your out-of-pocket max, but your deductible is still sitting there, untouched.

How do generic prescription copays fit in?

Generic drugs are the cheapest form of medication. Most plans encourage them by offering low copays - often $5, $10, or $15. But here’s where it gets messy:

There are three common plan structures:

- Single deductible (27% of plans): Your medical and prescription costs go toward one big deductible. Once you hit it, you pay coinsurance for everything - including prescriptions. Copays don’t exist here. You pay full price until the deductible is met.

- Separate deductibles (37% of plans): You have one deductible for doctor visits and hospital care, and another for prescriptions. You might pay $1,500 for medical and $750 for prescriptions. Only after hitting both do you start paying copays for meds. These copays then count toward your out-of-pocket maximum, but not toward your medical deductible.

- Copay-only (no prescription deductible) (36% of plans): You pay your $10 copay for generic meds right away - no deductible to meet. These copays count toward your out-of-pocket maximum, but not your medical deductible.

Most people are on #3. That’s why they’re confused. They pay $10 for their meds every month, assume it’s reducing their deductible, and are shocked when they still owe $1,500 for a hospital stay.

Real stories from real people

One user on HealthCare.gov wrote: ‘I paid $10 copays for my diabetes meds all year. Over $2,500 total. I thought I’d met my $2,000 deductible. I hadn’t. I still had to pay $2,000 for my knee surgery.’

Another, on Reddit, said: ‘I was so proud I paid $300 in copays for my asthma inhaler. Then I got billed $1,200 for an urgent care visit. I thought I was covered. I wasn’t. My deductible was still $1,200.’

But there’s good news too. Someone with Type 1 diabetes shared: ‘Before 2014, my insulin copays didn’t count toward anything. Now, they count toward my $8,500 out-of-pocket max. Last year, I hit it in October. My insulin was free for the rest of the year. That saved me thousands.’

How to avoid the trap

You don’t need a degree in health policy to understand your plan. Just check three things:

- Look at your Summary of Benefits and Coverage (SBC). It’s a one-page document your insurer is required to give you. Find the section labeled ‘Cost-Sharing.’ Look for the line: ‘Does this payment count toward your deductible?’ If it says ‘No’ next to ‘Copayment for generic drugs,’ you’ve found your answer.

- Check if you have a separate prescription deductible. If yes, you’ll pay full price for meds until you hit that number. Only after that do copays start.

- Track your spending. Keep a simple list: what you paid for doctor visits, ER trips, and prescriptions. Add them up. When you hit your out-of-pocket max, call your insurer to confirm - they’ll usually notify you, but don’t wait.

Pro tip: Most plans send you an annual statement showing your progress toward your deductible and out-of-pocket maximum. Don’t ignore it. Open it. Read it. Understand it.

What’s changing in 2025 and beyond

The government is trying to fix the confusion. Starting in 2025, insurers must make the ‘Does this count?’ language clearer in all plan documents. No more fine print.

Some insurers are testing a new model: one combined deductible for medical and prescriptions. Early results show people take their meds more often when they know every copay counts toward one goal - not two.

By 2027, experts predict 60% of major insurers will offer at least one plan where generic copays count toward the deductible. That’s a big shift. But for now, the rule still stands: copays help your out-of-pocket max, not your deductible.

What to do if you’re overwhelmed

If your plan feels like a maze, you’re not alone. Most people don’t understand this stuff. Here’s what to do:

- Call your insurer. Ask: ‘Do my generic drug copays count toward my deductible?’ They have to give you a clear answer.

- Use free tools like the Kaiser Family Foundation’s plan comparison tool. It breaks down costs in plain language.

- During open enrollment, spend 45 minutes reading your SBC. Don’t just pick the lowest premium. Pick the plan that makes sense for your health needs.

If you take daily meds, your out-of-pocket maximum is your real shield. Focus on that. Don’t waste energy wondering if your $10 copay is ‘doing something’ for your deductible. It’s not. But it’s helping you get to the day when your meds are free - and that’s what matters.

Do generic prescription copays count toward my deductible?

No, generic prescription copays typically do not count toward your medical deductible. They are treated as separate cost-sharing payments. Even if you’ve paid hundreds in copays for medications, your deductible - the amount you must pay before insurance shares costs for doctor visits or hospital stays - remains unchanged unless you’ve spent that exact amount on services that apply to it.

Do generic copays count toward my out-of-pocket maximum?

Yes, every generic prescription copay you pay counts toward your out-of-pocket maximum. This includes copays for doctor visits, ER visits, lab tests, and prescriptions. Once you hit your out-of-pocket maximum for the year, your insurance pays 100% of covered services for the rest of the year - including your medications.

Why don’t copays count toward the deductible if they’re part of my healthcare costs?

This is a design choice made by insurers and regulators. Deductibles are meant to encourage people to think twice before using expensive services - like ER visits or surgeries. Copays are fixed fees meant to make routine care affordable without triggering high costs. Keeping them separate allows insurers to manage risk and keep premiums lower. But it creates confusion because people assume all payments should reduce their overall financial responsibility the same way.

What’s the difference between a single deductible and separate medical and prescription deductibles?

A single deductible means all your medical and prescription costs count toward one total amount - say, $2,000. Once you hit it, coinsurance applies to everything. Separate deductibles mean you have two: one for doctor visits (e.g., $1,500) and another for prescriptions (e.g., $750). You must meet both before copays kick in for meds. Most plans today use separate deductibles, making it harder to track your progress.

How can I find out how my plan works?

Look at your Summary of Benefits and Coverage (SBC) document - it’s required by law and uses standardized language. Find the section on ‘Cost-Sharing’ and check the column that says ‘Does this payment count toward your deductible?’ for generic prescriptions. If it says ‘No,’ then your copays don’t count toward your deductible. You can also call your insurer and ask directly: ‘Do my generic drug copays count toward my deductible?’ They must answer clearly.

What happens when I reach my out-of-pocket maximum?

Once you reach your out-of-pocket maximum for the year, your insurance pays 100% of all covered services for the rest of the year. That includes doctor visits, hospital stays, surgeries, and prescriptions - even if you’re still paying copays. You won’t pay another dollar out of pocket for covered care until the next plan year begins.

Herman Rousseau

December 23, 2025 AT 10:26Bro, I was SO confused until I read this. I paid $300 in copays for my diabetes meds last year and thought I was halfway to my deductible. Nope. Still had to pay $2k for my knee surgery. This post saved me from a financial nightmare. 🙌

Johnnie R. Bailey

December 25, 2025 AT 06:11It’s a subtle but brutal design flaw - the system rewards healthy people who don’t need meds while punishing those who do. Copays are a Band-Aid on a hemorrhage. We treat healthcare like a vending machine: pay a fixed price, get a snack. But insulin isn’t a Snickers bar. It’s survival. And we’ve made survival contingent on understanding fine print.

Vikrant Sura

December 26, 2025 AT 04:49Lmao. So the government made it so your copays count toward the max but not the deductible… what a genius move. Now people are confused AND paying more. Classic US healthcare. Just charge more and call it ‘affordable.’

Art Van Gelder

December 26, 2025 AT 21:42Let me tell you, I spent 18 months trying to figure this out. I’d look at my EOBs like they were ancient runes. I’d see ‘$10 copay - generic’ and think, ‘Okay, that’s $10 off my deductible.’ Nope. It’s like your insurance is playing 3-card monte with your money. One pile is deductible, one is out-of-pocket max, and the third? That’s the ‘we hope you don’t notice’ pile. I finally called my insurer and said, ‘Is my $120/month for asthma inhalers doing anything for me?’ They paused. Then said, ‘Yes. It’s getting you closer to your $8,500 cap.’ I cried. Not from joy. From exhaustion.

Jeremy Hendriks

December 28, 2025 AT 04:00People need to stop acting like this is some kind of conspiracy. It’s capitalism. The system is designed to extract money from the sick and reward the healthy. If you’re taking daily meds, you’re a walking ATM. They don’t want you to hit the out-of-pocket max - they want you to keep paying. But hey, at least now you’re getting *some* credit. Grind the system, don’t let it grind you.

Kiranjit Kaur

December 28, 2025 AT 17:35OMG YES!! I’ve been screaming this for years 😭 I take 3 meds and my copays add up to $400/year. I thought I was ‘close’ to my deductible. Nope. My deductible was still $1,800. Then I got sick and had to go to urgent care - $600 bill. I almost cried. But then I realized - I was 40% to my out-of-pocket max. That’s the real win. Now I track it on a spreadsheet. 📊💖

Sai Keerthan Reddy Proddatoori

December 28, 2025 AT 20:02This is what happens when foreigners run our healthcare. In my country, you pay what you use. No confusing maxes. No tricks. Just pay. America makes everything complicated so the rich can hide behind insurance loopholes. We need real reform, not more paperwork.

Cara Hritz

December 30, 2025 AT 08:25Wait so if i pay 10$ for my pill every month does that count toward my ded? i thought it did? or no? i’m so confused now. my plan says no but i thought i read somewhere else it did? help??

Jamison Kissh

December 31, 2025 AT 01:01This is the quiet tragedy of modern healthcare: we’ve turned medical necessity into a math problem. You’re not just managing illness - you’re managing spreadsheets, EOBs, and insurance jargon. The real innovation isn’t in the drugs - it’s in the people who memorize their SBCs like they’re studying for a bar exam. We’ve made compassion conditional on literacy. And that’s not just broken - it’s immoral.