The global generic drug market isn’t just about cheap pills. It’s the backbone of affordable healthcare for billions. In 2024, generics made up 90% of all prescriptions in the U.S., but only 23% of total drug spending. That’s because they cost 80-85% less than brand-name drugs. And as healthcare budgets strain under rising chronic diseases and aging populations, this gap is widening - not shrinking.

Why Generic Drugs Are More Important Than Ever

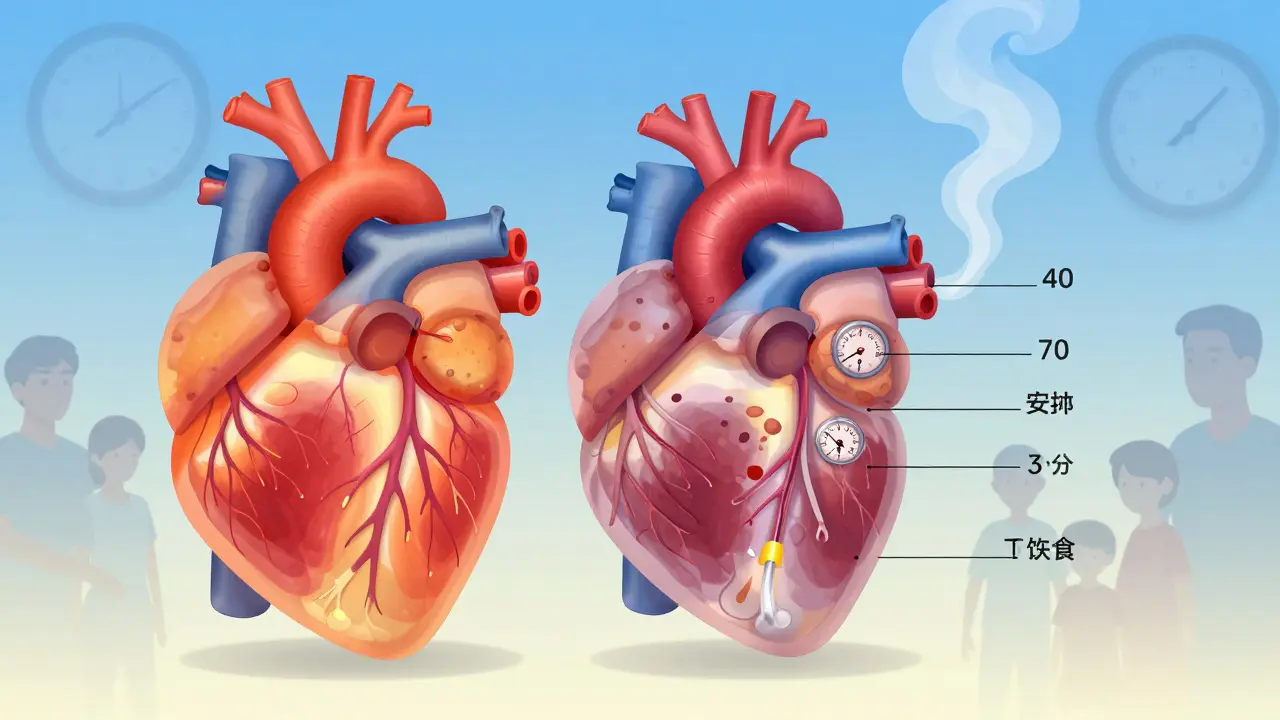

Global healthcare spending hit $9.8 trillion in 2024. Chronic conditions like diabetes, heart disease, and cancer now affect 41% of the world’s population. Treating these isn’t optional - it’s essential. But branded drugs? They’re often out of reach. That’s where generics come in.

Take insulin. A branded version can cost over $300 per vial in the U.S. The generic? Around $25. That’s not a minor difference - it’s the difference between life and death for millions. In India and Brazil, where out-of-pocket spending is high, generics make up over 80% of all medicines used. Without them, entire health systems would collapse under the weight of cost.

And it’s not just low-income countries. Even in Germany and Canada, where public insurance covers most drugs, generics are the first choice. Why? Because they work the same. The FDA and EMA require generics to match branded drugs in active ingredients, strength, dosage, and bioequivalence. No tricks. No shortcuts. Just the same medicine at a fraction of the price.

The Rise of Biosimilars: The New Frontier

Not all generics are created equal. The old-school kind - small-molecule pills like metformin or atorvastatin - are easy to copy. But the next wave? That’s biosimilars. These are copies of complex biologic drugs like Humira, Enbrel, or Keytruda. They’re not pills. They’re injectables made from living cells. Think of them as the difference between copying a simple recipe and cloning a live animal.

Producing a biosimilar takes 10 to 20 times more steps than making a traditional generic. Development costs? $100-250 million. For a regular generic? Just $1-5 million. That’s why only big players are entering this space - companies like Sandoz, Amgen, and Mylan. But the payoff is worth it. Biosimilars still save patients 15-30% compared to the original biologic. In 2024, over 100 biosimilars were approved worldwide. By 2030, that number could hit 300.

And they’re growing fast. Mordor Intelligence predicts a 12.3% annual growth rate for biosimilars between 2025 and 2030. That’s nearly double the pace of traditional generics. Oncology and autoimmune diseases are leading the charge. If you’re on a biologic today, chances are you’ll be switched to a biosimilar within the next five years.

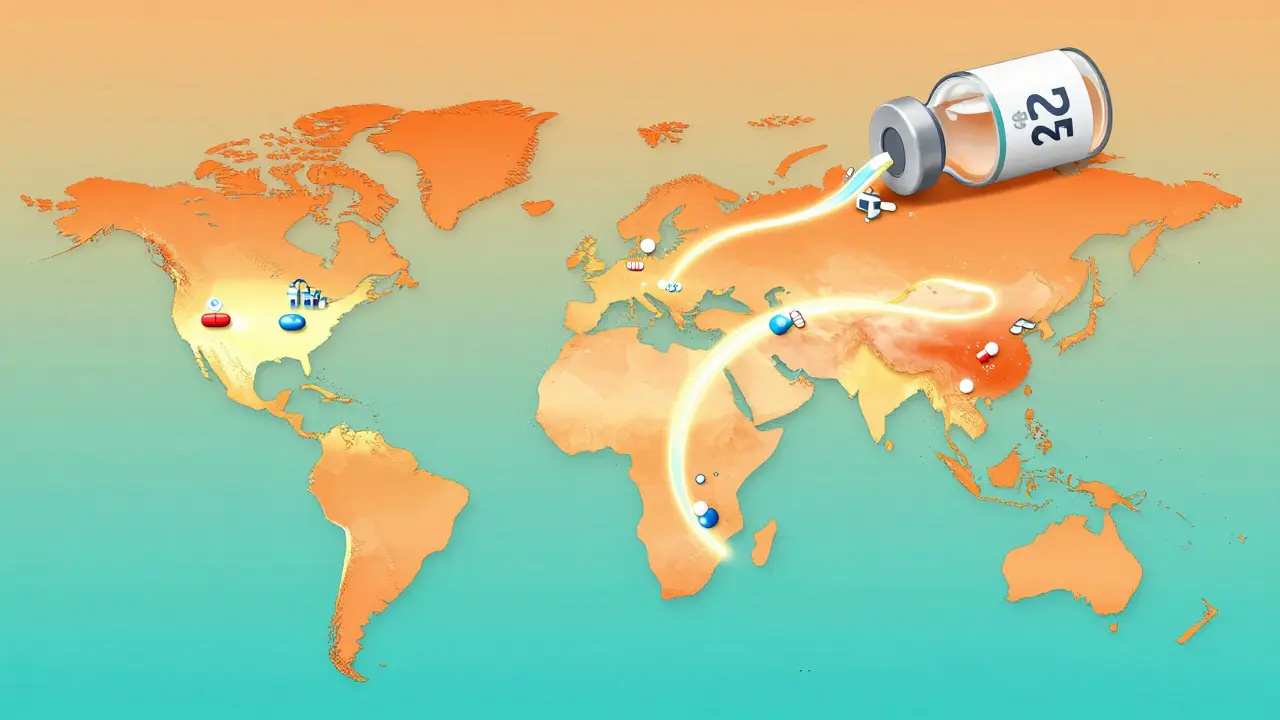

Who’s Driving the Market? The Pharmerging Giants

India and China aren’t just making generics - they’re reshaping the entire global supply chain. India produces over 60,000 generic medicines and supplies 20% of the world’s generic drug volume by volume. China makes 40% of the world’s active pharmaceutical ingredients (APIs) - the raw building blocks of every pill.

But it’s not just about volume. It’s about strategy. India’s government poured $1.34 billion into its Production Linked Incentive (PLI) scheme in 2024 to boost domestic API manufacturing. Why? To cut reliance on China. And it’s working. Companies like Sun Pharma and Dr. Reddy’s are building new plants, hiring engineers, and investing in tech to meet global quality standards.

Meanwhile, China is pushing its own agenda. Under the “Healthy China 2030” plan, the government is forcing local manufacturers to upgrade facilities or shut down. Over 1,200 plants failed FDA inspections between 2020 and 2024. Now, the survivors are investing in automation and real-time quality control. The result? Fewer warning letters, more exports.

And it’s not just Asia. Brazil, Turkey, Egypt, and Saudi Arabia are building their own generic industries. Egypt now requires 50% of essential medicines to be made locally by 2025. Saudi Arabia’s Vision 2030 is investing billions in pharmaceutical parks. These aren’t just local policies - they’re global shifts.

The Problem: Quality Control and Supply Chain Risks

Here’s the uncomfortable truth: not every generic is safe. In 2023, the FDA issued 187 warning letters to foreign manufacturers - 40% of them linked to quality issues. Contaminated batches. Poor sanitation. Fake records. These aren’t rare. They’re systemic.

The problem? Too many middlemen. A pill made in India might be packaged in Singapore, shipped through Dubai, and sold in a pharmacy in Chicago. Each stop adds risk. And regulators? They’re overwhelmed. The WHO counts 78 different regulatory systems worldwide. Some countries have zero inspection capacity. Others rely on outdated methods.

And then there’s the supply chain. China controls 65% of global API supply. What happens if a flood shuts down a factory in Shanghai? Or a trade war blocks exports? The U.S. and EU are scrambling to diversify. The EU just launched a $2 billion initiative to bring API production back to Europe. The U.S. is funding domestic manufacturing through the Defense Production Act. But scaling up takes years - and billions.

Market Shifts: Slowing Growth in the West, Fast Growth Elsewhere

North America and Western Europe aren’t standing still - but they’re not growing fast either. Price controls, tender systems, and aggressive bidding are squeezing margins. In Germany, generic prices drop 10-15% every year. In Italy, penetration is still under 30%. Why? Doctors and patients trust brands. Reimbursement rules favor them.

Meanwhile, pharmerging markets - India, Brazil, Indonesia, Nigeria, Egypt - are growing at 9.66% per year. Why? Rising incomes. Expanding insurance. Government mandates. In 2024, these markets added $112 billion in drug spending - 65% of the world’s total growth. By 2030, they’ll account for over half of all generic sales.

And the competition? It’s getting fierce. In 2024 alone, 37 major partnerships formed between global giants and local firms. Pfizer teamed up with a Nigerian distributor. Teva bought a Turkish manufacturer. These aren’t just deals - they’re survival tactics.

The Future: More Competition, Less Profit

Profit margins for generic manufacturers have fallen from 18% in 2020 to just 12% in 2024. Why? Too many players. Too many products. Too little differentiation. The low-hanging fruit - simple pills like ibuprofen or amoxicillin - is saturated. Companies are now chasing complex drugs: inhalers, injectables, combination therapies.

But here’s the catch: those require bigger investments, longer timelines, and deeper expertise. Only the top 10 global generic makers can afford it. The rest? They’re stuck making low-margin products or getting bought out.

By 2030, the global generic market will hit $689 billion. But its share of total pharmaceutical sales? It’s expected to drop from 57.56% in 2024 to around 53%. Why? Because specialty drugs - GLP-1 weight loss drugs, gene therapies, personalized cancer treatments - are growing faster. They’re expensive. They’re complex. And they’re not generic.

So what’s the future? It’s not about being the cheapest. It’s about being the most reliable. The most scalable. The most integrated. Companies that control their API supply, invest in biosimilars, and build local partnerships will win. The rest? They’ll fade.

What This Means for Patients and Systems

If you’re a patient, this is good news. More access. Lower prices. More choices. Especially in countries where generics were once hard to find.

If you’re a policymaker, the challenge is clear: strengthen regulation. Invest in inspection capacity. Push for local manufacturing. Don’t just rely on imports.

If you’re a manufacturer, the path is simple: get bigger, get smarter, get vertical. Own your supply chain. Build biosimilars. Partner locally. Or get out.

The global generic market isn’t dying. It’s evolving. And the winners won’t be the ones who make the cheapest pills. They’ll be the ones who make the safest, most reliable, and most accessible ones - no matter where you live.

Are generic drugs as safe as brand-name drugs?

Yes. Regulatory agencies like the FDA, EMA, and WHO require generics to prove they are bioequivalent to the brand-name drug - meaning they work the same way in the body. The active ingredient, dosage, and effectiveness must match exactly. The only differences are in inactive ingredients (like fillers) or packaging, which don’t affect safety or performance.

Why are biosimilars more expensive to make than regular generics?

Biosimilars are made from living cells, not chemicals. This means they require complex, precise manufacturing processes - like growing cells in bioreactors, purifying proteins, and ensuring consistency across batches. A single mistake can ruin an entire production run. Regular generics are simple chemical compounds made in factories with well-known reactions. Biosimilars cost 20-100 times more to develop and require years of testing to prove they’re safe.

Which countries are the biggest producers of generic drugs?

India and China are the top two. India produces over 60,000 generic medicines and supplies 20% of the world’s generic drug volume by volume. China manufactures about 40% of the world’s active pharmaceutical ingredients (APIs) - the core chemical components of all drugs. Together, they control roughly 35% of global generic manufacturing capacity.

Why do some countries have low generic usage despite low prices?

It’s often about trust and policy. In countries like Italy or Japan, doctors and patients still prefer branded drugs due to habit or marketing. Reimbursement rules sometimes favor brands. In others, weak regulatory oversight makes people wary of quality. Even if a generic is cheaper, if people don’t trust it, they won’t use it.

Will generic drugs disappear as biologics become more common?

No. While biologics and specialty drugs are growing fast, they’re still a small part of total prescriptions. Most people still take pills - for blood pressure, cholesterol, diabetes, infections. These will remain generics for decades. Biosimilars will replace some biologics, but the bulk of generic demand will come from simple, everyday medicines that won’t go away.

How are governments trying to secure generic drug supplies?

Many are investing in local production. The U.S. is using the Defense Production Act to fund domestic API manufacturing. The EU launched a €2 billion initiative to bring production back from Asia. India’s PLI scheme gives cash incentives to companies making APIs locally. Egypt and Saudi Arabia now require a percentage of essential medicines to be made within their borders. The goal? Reduce reliance on single countries and avoid supply shocks.

Payson Mattes

December 25, 2025 AT 03:43Did you know the FDA lets Chinese labs self-certify their own quality control? That’s not oversight-that’s a backdoor for contaminated meds to hit your pharmacy. I’ve got a cousin on insulin, and his generic vial had black specks. He called the pharmacy-they said ‘it’s normal.’ Normal? My guy ended up in the ER. This isn’t about cost-it’s about who’s really pulling the strings behind the supply chain.

Isaac Bonillo Alcaina

December 25, 2025 AT 04:34There is a fundamental epistemological flaw in the assumption that bioequivalence equates to therapeutic equivalence. The FDA’s criteria for generic approval are based on AUC and Cmax thresholds of 80–125%, which permits statistically significant pharmacokinetic variance-variance that, in vulnerable populations (e.g., elderly, renally impaired), may precipitate subtherapeutic or toxic exposure. This is not science. It is regulatory arbitrage masquerading as public health policy.

Bhargav Patel

December 26, 2025 AT 22:50The rise of generics is not merely an economic phenomenon-it is a moral one. In a world where healthcare is treated as a commodity, the humble generic pill becomes the great equalizer. It does not ask for your income, your insurance, or your nationality. It simply works. And yet, we treat it with suspicion-while paying tenfold for the same molecule wrapped in glossy packaging and celebrity endorsements. Perhaps the real crisis is not in the supply chain, but in our collective inability to value simplicity over spectacle.

India and China, though vilified, are the quiet architects of global health equity. Their factories do not advertise on billboards, but they keep millions alive. We must remember: behind every tablet is a worker, a village, a family. To dismiss their output is to dismiss the dignity of those who make it possible.

Steven Mayer

December 27, 2025 AT 10:27The biosimilar development curve is non-linear due to the inherent heterogeneity of protein folding in mammalian expression systems. The analytical burden for comparability is orders of magnitude higher than for small-molecule generics-requiring advanced chromatographic profiling, mass spectrometry deconvolution, and immunogenicity risk assessment across multiple patient cohorts. The $100M+ capex isn’t overhead-it’s a necessity for regulatory compliance under ICH Q5 and Q6B. Margins are compressed because the market is saturated with low-tier players who lack the CMC expertise to navigate the complexity.

Charles Barry

December 28, 2025 AT 19:15They’re lying to you. Every single one of them. The ‘same active ingredient’ line? Bullshit. The fillers are different-fillers that trigger autoimmune flares in 1 in 12 patients. And the FDA? They’re owned by Big Pharma. The warning letters? Just PR theater. Real inspections? Done once every seven years in India. Meanwhile, your local pharmacy is selling you a $5 pill that’s been sitting in a Dubai warehouse for 14 months. You think that’s safe? You’re a fool.

Rosemary O'Shea

December 29, 2025 AT 10:07How quaint. We’re celebrating generics like they’re a humanitarian achievement, while ignoring the fact that the entire system is built on the exploitation of laborers in Bangalore and the environmental devastation of the Ganges basin. Do you know how many rivers are poisoned by API waste? Do you care? Or is it easier to pat yourself on the back for buying a $5 insulin vial while pretending you’re not complicit in a global ecological crime?

Joe Jeter

December 31, 2025 AT 02:47Everyone says generics are safe. But have you ever looked at the FDA’s 483 inspection reports? Half the manufacturers flagged for ‘inadequate cleaning validation’ are still selling to U.S. pharmacies. And yet, the narrative is ‘affordable access.’ Maybe the problem isn’t the generics-it’s that we’ve normalized risk because we don’t want to pay more.

Sidra Khan

December 31, 2025 AT 15:29