When you’re on multiple medications for conditions like high blood pressure, diabetes, or cholesterol, your doctor might prescribe a generic combination drug-a single pill that contains two or more active ingredients. But here’s the catch: your insurance might cover the individual generics separately, but not the combo pill. Or worse, the combo might cost you more. This isn’t a glitch. It’s how insurance formularies work-and it can cost you hundreds a year.

Why Insurance Prefers Separate Generics

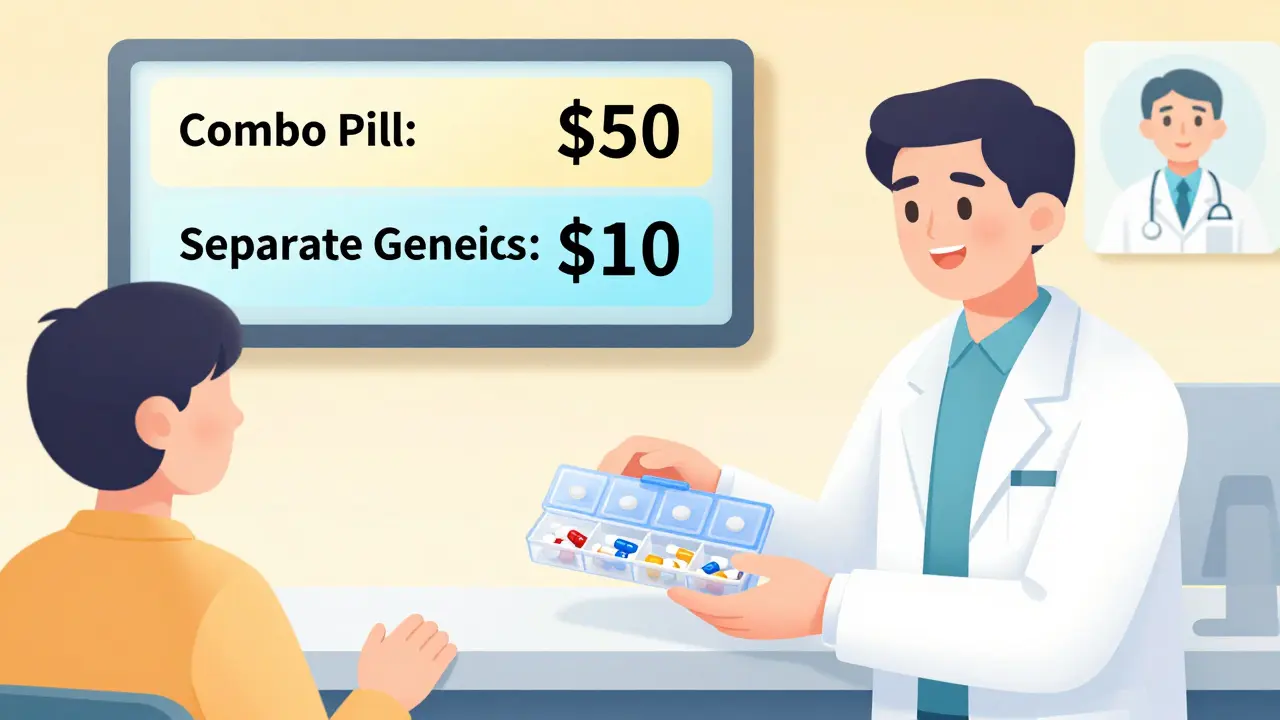

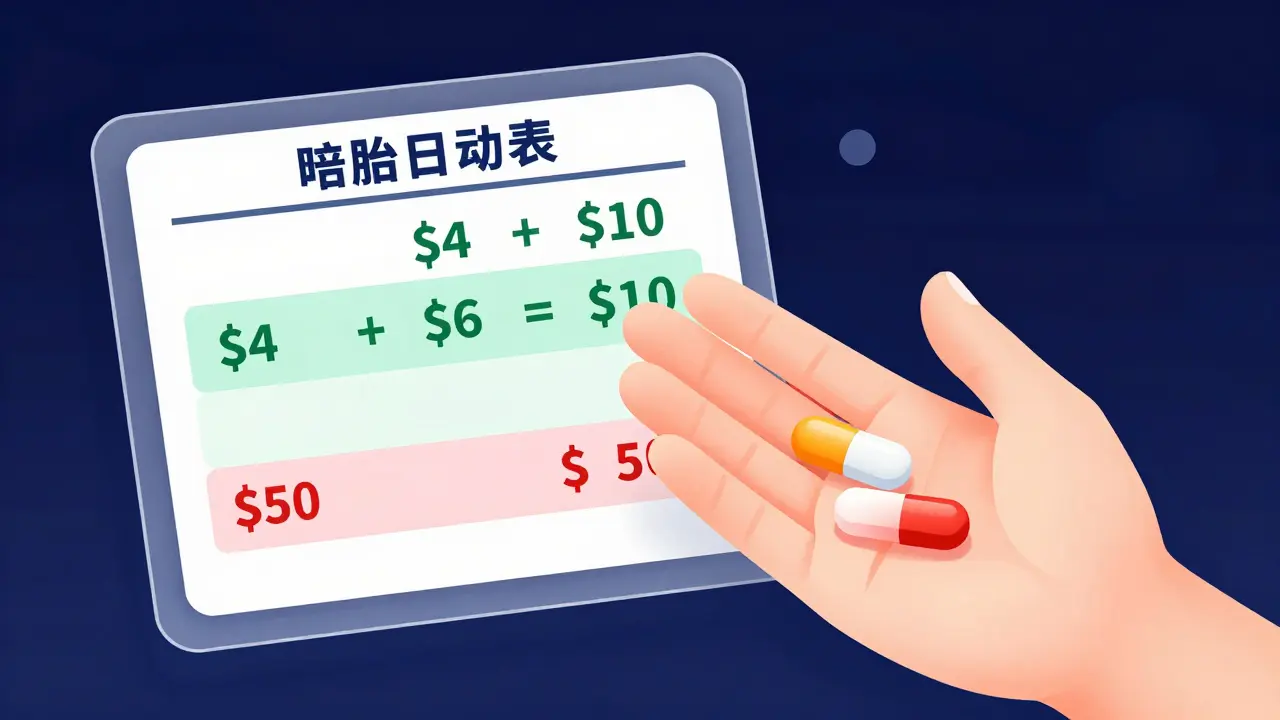

Most insurance plans, including Medicare Part D and private plans, are built to save money. And they do it by pushing you toward the cheapest option. That’s why 84% of all prescription products in Medicare Part D in 2019 had generic-only coverage-meaning brand names were blocked unless you appealed. But here’s the twist: when it comes to combination drugs, insurers often treat the combo differently than the sum of its parts.Let’s say you need a pill with amlodipine and lisinopril for high blood pressure. The combo pill (like Caduet) might cost $50 a month. But if you take two separate generics-amlodipine at $4 and lisinopril at $6-you’re paying $10. That’s a 80% savings. So insurers will often cover the two individual generics at Tier 1 (lowest cost) but place the combo pill in Tier 3 or higher. Why? Because they know you can get the same effect cheaper by splitting it up.

It’s not that the combo is unsafe. The FDA says generic combos are chemically identical to brand-name versions. But insurance doesn’t care about chemical identity-it cares about cost. If two pills cost less than one, they’ll make it easy to get the two pills and hard to get the one.

How Formularies Decide What’s Covered

Every insurance plan has a formulary-a list of drugs they cover, sorted into tiers. Tier 1 is usually generic drugs with the lowest copay-often $0 to $5. Tier 2 is preferred brand names. Tier 3 is non-preferred brands. And Tier 4 or 5? That’s for specialty drugs, which can cost over $100.For combination drugs, the placement depends on:

- Whether a generic version of the combo exists

- How many manufacturers make the individual generics

- Whether the combo is a "single-source generic" (only one company makes it)

Single-source generics are tricky. Even though they’re "generic," if only one company makes them, they don’t face price competition. That means they can cost nearly as much as the brand name. Insurers notice this. They’ll often avoid covering them unless absolutely necessary.

On the other hand, if there are 10 companies making amlodipine and 8 making lisinopril, the prices drop. That’s why amlodipine can cost $2 a month and lisinopril $3. Insurance knows this. So they’ll encourage you to take two pills instead of one-even if it means swallowing more pills.

When the Combo Is Actually Cheaper

It’s not always the case that two separate generics cost less. Sometimes, the combo pill is the cheaper option. That usually happens when:- The combo is newly generic and still has low competition

- The individual generics are not on Tier 1

- The combo has a manufacturer coupon or patient assistance program

Take a patient on a combo of metformin and sitagliptin for type 2 diabetes. The brand version cost $450 a month. When the combo went generic, the price dropped to $12. But the individual generics? Metformin was $5, sitagliptin was $20. So the combo at $12 was still cheaper. In this case, the plan covered the combo at Tier 1. The patient saved $13 a month just by taking one pill.

That’s why you can’t assume the combo is always more expensive. You have to check your plan’s formulary. And you have to ask your pharmacist. They see this every day.

Why Patients Get Confused-and Overpay

Most people don’t know how formularies work. They assume if their doctor prescribes a combo pill, insurance will cover it the same way. But that’s not true. One Reddit user, PharmaPatient87, shared that their plan charged $10 for each individual generic-but $50 for the combo. They had to ask their doctor to write two separate prescriptions to save $30 a month.Another user, SeniorHealth45, said their combo blood pressure pill went generic and their cost dropped from $45 to $7. Same ingredients. Same effectiveness. Just a different pill form. The difference? The combo was now on Tier 1.

This isn’t random. It’s based on:

- What the pharmacy benefit manager (PBM) negotiated with drugmakers

- Whether the combo is listed as a "preferred" product

- Whether the insurer has a step therapy rule (try individual drugs first)

And here’s the kicker: 68% of Medicare beneficiaries need help understanding their drug coverage. If you’re not sure why your combo costs more, you’re not alone.

What You Can Do to Save Money

You don’t have to accept whatever your plan says. Here’s how to take control:- Check your plan’s formulary online. Look up both the combo drug and the individual ingredients. Compare the copay for each.

- Ask your pharmacist. They can tell you which version is cheaper and whether your plan allows splitting prescriptions.

- Ask your doctor to write separate prescriptions. If the individual generics are cheaper, your doctor can prescribe them separately. Most plans allow this.

- Use GoodRx or SingleCare. These apps show cash prices. Sometimes paying cash for the combo is cheaper than using insurance.

- File a coverage appeal. If your combo is cheaper and clinically better (e.g., easier to take), your doctor can submit a prior authorization request. It takes 72 hours for a standard request, 24 for urgent cases.

Also, remember: since January 1, 2024, Medicare Part D has capped out-of-pocket drug costs at $2,000 a year. That means even if your combo is more expensive, you won’t pay more than that total. But if you can avoid hitting that cap by choosing cheaper options, you’ll have more room for other meds.

The Bigger Picture: Why This Matters

Combination drugs aren’t just about convenience. They improve adherence. People who take one pill a day are 30% more likely to stick to their regimen than those taking two or three. That’s why doctors push combos-they reduce missed doses, hospital visits, and complications.But insurance doesn’t always reward that. It rewards the lowest upfront cost. That creates a tension between clinical benefit and financial incentive. And patients end up caught in the middle.

That’s changing. The FDA is speeding up generic approvals under GDUFA III. More combo generics are coming. By 2028, the U.S. generic drug market will hit $219 billion. And 93% of prescriptions will be generic. That means more combos will be affordable.

For now, though, you have to be your own advocate. Know your plan. Know your drugs. Ask questions. And don’t assume the combo pill is the expensive one-sometimes, it’s the best deal.

Why does my insurance cover two separate generic pills but not the combination pill?

Insurance plans often cover separate generic pills because they’re cheaper. If the cost of two individual generics is lower than the combo pill, the plan will encourage you to take them separately to save money. This isn’t about safety-it’s about cost. Your plan’s formulary is designed to steer you toward the lowest-cost option, even if it means taking more pills.

Can I ask my doctor to prescribe the individual generics instead of the combo?

Yes, absolutely. Many doctors are happy to do this if it saves you money. Just make sure the individual generics are available and that your plan covers them at a low tier. Your pharmacist can confirm which versions are covered and at what cost. You’ll need separate prescriptions, but most insurers allow this.

Is a generic combination pill as effective as the brand-name version?

Yes. The FDA requires generic combination pills to be bioequivalent to the brand-name version-meaning they work the same way in your body, with the same active ingredients, strength, and dosage. The only differences might be in inactive fillers, which rarely affect how the drug works. For most people, generics are just as safe and effective.

What if the combo pill is cheaper than the individual generics?

That happens more often than you think-especially with newer generic combos. If the combo is priced lower than buying the two pills separately, your plan may cover it at a lower tier. Always check your formulary or ask your pharmacist. Sometimes, the combo is the best deal.

How do I appeal if my insurance won’t cover my combo pill?

Your doctor can file a coverage determination request. You’ll need a letter explaining why the combo is medically necessary-for example, if taking multiple pills is hard for you to manage. The plan has 72 hours to respond for a standard request, or 24 hours for urgent cases. If denied, you can appeal again. Many approvals happen on the second try, especially if clinical guidelines support the combo.

Are there any new rules that help with generic drug costs?

Yes. Starting in 2024, Medicare Part D eliminated deductibles and capped annual out-of-pocket drug spending at $2,000. Also, a 2023 court ruling banned copay accumulator programs, meaning manufacturer discounts now count toward your out-of-pocket maximum. These changes make it easier to afford both generic combos and individual generics, especially if you use patient assistance programs.

Malik Ronquillo

January 22, 2026 AT 13:38Why do insurers even bother with combos? Just give us the two pills and save us cash. I’ve been taking amlodipine and lisinopril separate for years. One pill? Nah. I don’t need the convenience. I need the $40 back.

Ryan Riesterer

January 23, 2026 AT 00:36The formulary architecture is fundamentally misaligned with pharmacoeconomic incentives. PBMs prioritize per-unit cost efficiency over adherence metrics, creating artificial fragmentation of therapeutic regimens. The clinical utility of fixed-dose combinations-demonstrated in multiple RCTs-is systematically de-prioritized in favor of low-tiered monotherapies, even when bioequivalence is incontrovertible.

Akriti Jain

January 24, 2026 AT 11:52😂 Big Pharma and insurance are in cahoots. They want you to swallow 3 pills a day so you forget one and end up in the ER. Then they charge you $8,000 for the ambulance. 🤡💊

Hilary Miller

January 26, 2026 AT 09:06My mom took two pills. Now she takes one. She forgot less. Her BP is better. Simple.

Margaret Khaemba

January 27, 2026 AT 18:39Wait-so if the combo is cheaper, why won’t my plan cover it? I checked GoodRx and the combo’s $8, but the two separate ones are $12. Shouldn’t that be the preferred option? Is my plan broken?

Alec Amiri

January 29, 2026 AT 12:40They’re not trying to help you. They’re trying to make you suffer. That’s why they make you take 3 pills. So you give up. So you stop taking them. So you get sick. So they make money off your hospital stay. It’s not a glitch. It’s a business model.

Lana Kabulova

January 29, 2026 AT 15:59Actually-this is worse than you think. The combo might be cheaper today, but next month, the manufacturer raises the price by 15% and the PBM drops it to Tier 4. Meanwhile, the individual generics stay at $3 because there are 14 manufacturers. You think you’re saving? You’re just playing Russian roulette with your formulary.

Chiraghuddin Qureshi

January 31, 2026 AT 08:25India does this better. We get combo generics for $0.50/month. No formulary drama. No appeals. Just pills. 🇮🇳💊

Mike P

February 2, 2026 AT 03:52U.S. healthcare is a joke. We pay 5x more for the same meds. If you're not screaming about this, you're part of the problem. Fix your system or get out. 🇺🇸💀

Keith Helm

February 2, 2026 AT 08:25It is imperative to consult the most current formulary documentation issued by the respective Pharmacy Benefit Manager, as tier placement may vary by region, contract year, and therapeutic category. Failure to do so constitutes a material risk to financial and clinical outcomes.

Oren Prettyman

February 4, 2026 AT 00:58Let me be clear: this entire system is a sham. The FDA approves generics based on bioequivalence, yet insurers act as if they’re different drugs. Why? Because the PBM gets kickbacks from the manufacturers of individual generics. The combo? No rebate. So it gets penalized. This isn’t about cost-it’s about corruption. And the fact that you’re surprised by this proves how little you understand how this industry actually works.

Rob Sims

February 4, 2026 AT 08:25My doctor told me to switch to the combo. Insurance said no. I paid cash for it. $12. The two generics? $52 with insurance. So I told my doctor to write the combo. Now I’m saving $40 a month. And I’m not even mad anymore. Just… done.

Liberty C

February 6, 2026 AT 04:07Oh, so now we’re supposed to be medical bill analysts? I paid for a doctor to tell me what to take-not to become a spreadsheet jockey comparing copays across 12 different tiers, three different PBMs, and a pharmacy that won’t accept GoodRx on Tuesdays. This isn’t healthcare. It’s a horror game where the only winning move is not to play.

Daphne Mallari - Tolentino

February 6, 2026 AT 22:11One must acknowledge the inherent tension between pharmaceutical innovation and cost-containment mechanisms. While the clinical advantages of fixed-dose combinations are well-documented, the structural disincentives embedded within the U.S. healthcare reimbursement paradigm render such innovations economically nonviable for payers unless they achieve significant market penetration. This is not a failure of policy-it is a logical outcome of market design.